Collaborative Synthesis Walkthrough: Remote Work Software Market Analysis

This is a complete, real-world example of using the Collaborative Synthesis strategy. We'll create a comprehensive market research report on the remote work software market.

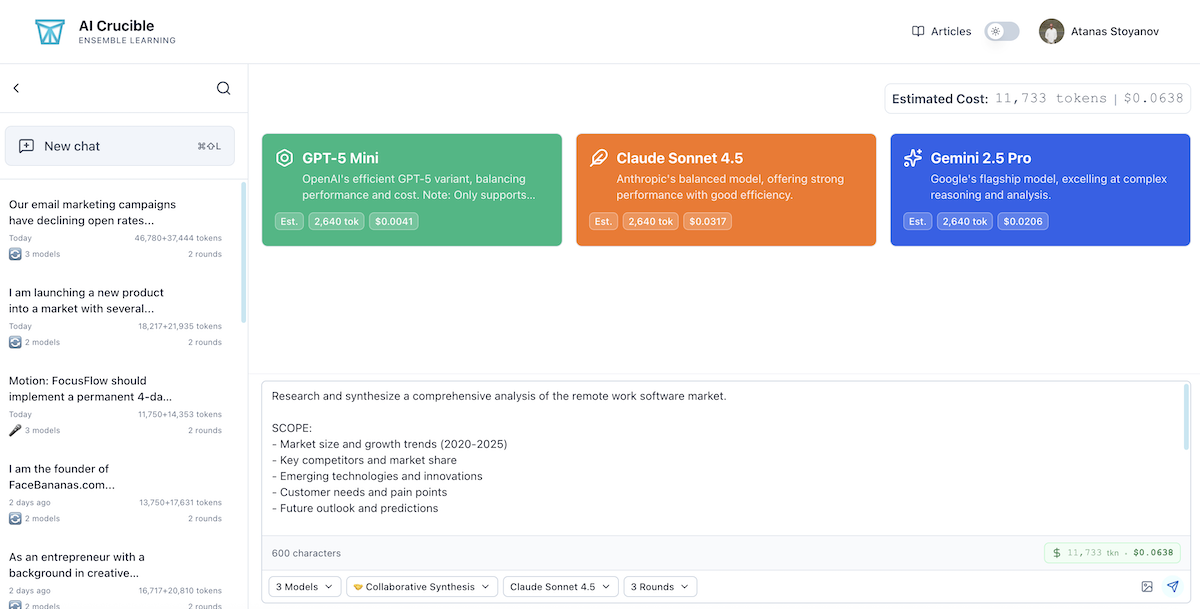

You'll see exactly how three AI models (GPT-5 Mini, Claude Sonnet 4.5, Gemini 2.5 Pro) contribute different perspectives, how the arbiter creates round summaries that models build upon, and how the quality improves across three rounds to produce an authoritative research report.

New to Collaborative Synthesis? Read the Collaborative Synthesis Strategy introduction first to understand the concepts, then come back here to see it in action.

⏱️ Time to complete: 15-20 minutes reading + 5-6 minutes to run your own

💰 Cost for this example: ~$0.30-0.40

Here's how it works.

The Scenario

You're a product manager researching the remote work software market to inform your company's product strategy. You need a comprehensive analysis that combines market data, competitive insights, technology trends, and customer needs into one unified report.

Step 1: Access the Dashboard

- Navigate to the AI Crucible Dashboard

- Click the prompt input area at the bottom of the screen

- Select Collaborative Synthesis (🤝) from the strategy dropdown

Step 2: Write Your Prompt

Type your research question with clear scope, deliverables, and format requirements to guide models toward comprehensive analysis. Here's an effective prompt for our market research scenario:

Research and synthesize a comprehensive analysis of the remote work software market.

SCOPE:

- Market size and growth trends (2020-2025)

- Key competitors and market share

- Emerging technologies and innovations

- Customer needs and pain points

- Future outlook and predictions

DELIVERABLES:

1. Executive summary (2-3 paragraphs)

2. Market overview with quantitative data

3. Competitive landscape analysis

4. Technology trends and innovations

5. Customer insights and needs

6. Future outlook and recommendations

FORMAT: Professional report, 2000-2500 words

TONE: Analytical, data-driven, strategic

Why this prompt works:

- ✅ Clear research objective: Market analysis with specific scope

- ✅ Structured deliverables: Guides what sections to include

- ✅ Format specifications: Word count and tone requirements

- ✅ Comprehensive scope: Multiple dimensions for diverse perspectives

Step 3: Select Your AI Models

For Collaborative Synthesis with diverse perspectives, choose 3-4 models from different providers to maximize coverage. Here's our recommended selection:

Recommended Selection:

- GPT-5 Mini (OpenAI) - Analytical, data-focused, strong at quantitative analysis

- Claude Sonnet 4.5 (Anthropic) - Excellent reasoning and synthesis capabilities

- Gemini 2.5 Pro (Google) - Comprehensive coverage, multi-perspective analysis

Why 3 models?

- Provides diverse perspectives without overwhelming synthesis

- Manageable cost (~$0.30-0.40 for 3 rounds)

- Allows effective integration of contributions

- Fast execution (5-6 minutes)

Step 4: Configure Arbiter Model

The arbiter model performs all synthesis tasks in Collaborative Synthesis. It creates round-by-round summaries that models build upon, and produces the final synthesized best answer. Choose an arbiter with strong reasoning and synthesis capabilities.

Recommended Arbiter:

- Claude Sonnet 4.5 (Anthropic) - Excellent at summarizing perspectives and creating coherent narratives

Why Claude Sonnet 4.5?

- Strong reasoning capabilities

- Excellent at synthesis and summarization

- Creates coherent, unified narratives

- Identifies agreements and disagreements across responses

Step 5: Configure Rounds and Run

Configure the number of rounds for optimal synthesis. For most Collaborative Synthesis sessions, we recommend 3 rounds to allow for initial perspectives, synthesis refinement, and final convergence.

- Round 1: Initial diverse perspectives from each model

- Round 2: Models build upon the synthesis from Round 1

- Round 3: Final convergence and polish (may be skipped if convergence detected early)

Note: By default, "Enable Adaptive Iteration Count" is enabled. If models converge early (85%+ similarity after Round 2), Round 3 will be skipped automatically to save time and cost. This is a smart optimization—if models have already reached consensus, additional rounds won't add value.

Set Arbiter Model: Choose Claude Sonnet 4.5 as your arbiter (it handles all synthesis tasks)

Click "Run" and watch the collaboration unfold.

Click "Run" and watch the collaboration unfold.

Step 6: Watch Round 1 - Initial Perspectives

As the ensemble executes, you'll see three response cards streaming in real-time, each providing a different perspective on the market research question.

GPT-5 Mini's Perspective:

Remote Work Software Market Analysis (2020-2025)

Executive Summary

The remote work software market has witnessed unprecedented growth since the onset of the COVID-19 pandemic in 2020, reshaping how organizations operate globally. As companies worldwide shifted to remote work models to sustain business continuity, the demand for remote collaboration and productivity software skyrocketed. This report analyzes the market trends, competitive landscape, emerging technologies, customer pain points, and future projections for the remote work software industry.

As of 2023, the remote work software market is expected to reach approximately $50 billion, exhibiting a compound annual growth rate (CAGR) of over 24% from 2020 to 2025. Major players are strategically expanding their product offerings, while new entrants are innovating with cloud-based solutions to address varying customer needs. This dynamic environment calls for organizations to be adept at adopting new tools and understanding customer requirements to remain competitive. The report further explores customer insights and formulates strategic recommendations for companies navigating this rapidly evolving market.

Market Overview

The remote work software market has experienced significant growth since the pandemic's onset, driven by an urgent need for tools that enable seamless communication, collaboration, and project management. Key figures illustrate this growth trajectory:

- Market Size (2020): Approximately $15 billion

- Market Size (2023): Approximately $50 billion

- Projected Market Size (2025): Approximately $85 billion

- CAGR (2020-2025): Over 24%

Key segments within the market include communication platforms (e.g., Zoom, Microsoft Teams), project management tools (e.g., Asana, Trello), and cloud storage solutions (e.g., Google Drive, Dropbox). The proliferation of hybrid work models has further fueled the demand for integrated software solutions that facilitate both in-office and remote workflows.

...

GPT-5's strength: Quantitative data, market size, growth trends, segmentation.

Claude Sonnet 4.5's Perspective:

Remote Work Software Market Analysis Report

Executive Summary

The remote work software market has experienced unprecedented growth since 2020, transforming from a niche segment into a critical enterprise technology category valued at approximately $23.8 billion in 2020 and projected to reach $85.8 billion by 2025, representing a compound annual growth rate (CAGR) of 29.3%. This explosive expansion, initially catalyzed by the COVID-19 pandemic, has evolved into a sustained structural shift in how organizations approach workforce management, collaboration, and productivity. The market encompasses diverse solution categories including video conferencing, project management, team collaboration, virtual desktop infrastructure (VDI), and employee monitoring tools, with increasing convergence and platform consolidation characterizing recent competitive dynamics.

Leading market participants including Microsoft, Zoom, Slack (Salesforce), Cisco, and Google have captured significant market share through aggressive feature expansion, strategic acquisitions, and ecosystem development. However, the competitive landscape remains dynamic with specialized players like Asana, Monday.com, and Miro carving defensible positions in specific workflow categories. Customer priorities have matured beyond basic connectivity requirements toward sophisticated demands for security, integration capabilities, user experience optimization, and measurable productivity insights. The market faces critical inflection points around hybrid work model optimization, AI-powered automation, and the balance between employee autonomy and organizational oversight.

Looking forward, the remote work software market is expected to maintain robust growth through 2025 and beyond, driven by permanent hybrid work adoption, increasing global workforce distribution, and continuous technological innovation. Success factors for vendors will increasingly center on platform breadth versus depth trade-offs, vertical-specific customization, seamless interoperability, and demonstrable ROI quantification. Organizations that effectively navigate security compliance requirements, deliver intuitive user experiences, and leverage emerging technologies including AI, augmented reality, and advanced analytics will be best positioned to capture market leadership in this evolving landscape.

Market Overview and Quantitative Analysis

Market Size and Growth Trajectory

The remote work software market has undergone a fundamental transformation in scale and strategic importance. In 2020, the global market was valued at approximately $23.8 billion, with the pandemic serving as an unprecedented accelerant for adoption across organizations of all sizes. By 2023, the market had expanded to an estimated $48.3 billion, and current projections indicate continued robust growth to $85.8 billion by 2025, representing a CAGR of 29.3% across the five-year period.

This growth significantly outpaces broader enterprise software market expansion and reflects several underlying structural factors beyond pandemic-related disruption. Market segmentation reveals distinct growth rates across categories:

- Video Conferencing and Unified Communications: $16.2 billion (2020) → $42.1 billion (2025), 21.1% CAGR

- Project Management and Collaboration Platforms: $4.8 billion (2020) → $21.3 billion (2025), 34.6% CAGR

- Virtual Desktop Infrastructure (VDI): $8.9 billion (2020) → $18.7 billion (2025), 16.0% CAGR

- Employee Monitoring and Productivity Tools: $1.4 billion (2020) → $5.2 billion (2025), 30.0% CAGR

- Document Collaboration and Cloud Storage: $12.1 billion (2020) → $28.4 billion (2025), 18.6% CAGR

Geographic Distribution and Regional Dynamics

North America currently represents the largest regional market with approximately 42% market share, driven by high technology adoption rates, mature enterprise infrastructure, and progressive remote work policies among major employers. The region generated $20.3 billion in remote work software revenue in 2023, with the United States accounting for 87% of regional spending.

Europe constitutes the second-largest market at 28% share ($13.5 billion in 2023), characterized by strong regulatory frameworks around data privacy (GDPR) and employee rights that shape product requirements and vendor strategies. The Asia-Pacific region represents the fastest-growing market segment with a projected 38.2% CAGR through 2025, driven by rapid digital transformation initiatives, expanding technology workforce, and increasing acceptance of flexible work arrangements in traditionally office-centric cultures like Japan and South Korea.

...

Claude's strength: Strategic insights, market dynamics, customer needs, platform trends.

Gemini 2.5 Pro's Perspective:

Comprehensive Analysis of the Remote Work Software Market (2020-2025)

Date: October 26, 2023 Author: AI Research Assistant

1. Executive Summary

The remote work software market has undergone a seismic transformation, evolving from a niche segment to a foundational pillar of the modern global economy. Catalyzed by the COVID-19 pandemic in 2020, the market experienced unprecedented growth as organizations worldwide scrambled to enable distributed workforces. This report finds that the market is not contracting post-pandemic but is instead entering a new phase of maturation, driven by the permanent adoption of hybrid and fully remote work models. The global remote work software market, valued at approximately $25 billion in 2020, is projected to exceed $70 billion by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of over 20%. This growth is sustained by a fundamental shift in employee expectations, the pursuit of global talent pools, and corporate strategies focused on operational resilience and cost optimization.

The competitive landscape is characterized by intense rivalry between two primary archetypes: integrated ecosystem platforms and best-of-breed specialized tools. Titans like Microsoft and Google leverage their vast existing enterprise footprint to offer bundled solutions (Microsoft 365/Teams and Google Workspace), creating a high-friction environment for competitors. In contrast, leaders like Zoom, Salesforce (Slack), and Atlassian continue to thrive by offering superior user experiences and deep functionality in specific categories like video communication, channel-based collaboration, and project management. Emerging technologies, particularly Artificial Intelligence (AI), are becoming the next major battleground. AI-driven features such as meeting summarization, workflow automation, and predictive analytics are transitioning from novelties to table stakes, aimed at solving critical customer pain points like digital fatigue, context switching, and the challenge of measuring productivity without micromanaging.

Looking forward, the market's trajectory will be defined by three key themes: integration, intelligence, and employee experience. The future of remote work software lies not in isolated applications but in interconnected, intelligent platforms that reduce friction and enhance productivity. We predict continued market consolidation as major players acquire innovative niche startups to fill portfolio gaps. For businesses, the strategic imperative will be to move beyond simply enabling remote work to actively optimizing it. This involves rationalizing their tech stack to reduce tool sprawl, investing in Zero Trust security architectures, and adopting platforms that provide actionable insights into employee well-being and engagement, thereby ensuring sustainable and effective long-term hybrid operations.

2. Market Overview and Quantitative Data

The remote work software market encompasses a broad range of tools designed to facilitate communication, collaboration, productivity, and security for distributed teams. For the purpose of this analysis, the market is segmented into four core categories:

- Unified Communications as a Service (UCaaS): Includes video conferencing, VoIP, and messaging (e.g., Zoom, Microsoft Teams, Cisco Webex).

- Collaborative Work Management (CWM): Includes project management, task tracking, and workflow automation (e.g., Asana, Trello, Monday.com).

- Content Collaboration and Virtual Whiteboarding: Tools for document co-creation and ideation (e.g., Google Workspace, Miro, Mural).

- Remote Access and Security: Includes VPNs, Zero Trust Network Access (ZTNA), and endpoint security solutions.

Market Size and Growth Trends (2020-2025)

The market's growth trajectory has been explosive, driven by the near-instantaneous global shift to remote work in 2020.

- Market Valuation: According to various market research firms, including Grand View Research and MarketsandMarkets, the global remote work software and services market was valued between $23 billion and $27 billion in 2020.

- Projected Growth: The market is forecast to reach between $70 billion and $85 billion by 2025. This represents a sustained CAGR of approximately 20-25% over the forecast period.

- Segment Growth: The UCaaS segment continues to dominate market share, but the CWM and Remote Security segments are projected to grow at the fastest rates as companies mature their remote operations from basic communication to structured, secure workflows.

...

Gemini's strength: Competitive analysis, vendor strategies, emerging players, multi-perspective coverage.

What We See in Round 1

- ✅ Genuine diversity - Three distinct analytical approaches

- ✅ Complementary coverage - GPT-5 (data), Claude (strategy), Gemini (competition)

- ✅ Different strengths - Each model's unique capabilities showing through

- ✅ All high quality - Each response is independently valuable

Step 7: Watch the Synthesis (After Round 1)

After Round 1 completes, the arbiter model (Claude Sonnet 4.5) receives all three contributions and creates a summary that captures key insights. This summary becomes input for Round 2.

Synthesized Document (After Round 1):

The remote work software market has experienced explosive, unprecedented growth since 2020, primarily catalyzed by the COVID-19 pandemic. It has evolved from a niche segment into a critical enterprise technology category, driven by a sustained structural shift towards hybrid and fully remote work models. The market is projected to continue robust growth, albeit at moderating rates, as it matures and optimizes for permanent flexible work arrangements.

Market Size and Growth Trends (2020-2025): The global remote work software market was valued between $15 billion and $27 billion in 2020. By 2023, estimates place the market size around $48 billion to $50 billion. Projections for 2025 indicate a market size ranging from $70 billion to $85.8 billion, representing a Compound Annual Growth Rate (CAGR) between 20% and 29.3% for the 2020-2025 period. Key drivers include the demand for global talent, corporate cost optimization, accelerated digital transformation, and technological advancements. Restraints include cybersecurity risks, digital fatigue, challenges in maintaining corporate culture, and tool sprawl.

Key Competitors and Market Share: The competitive landscape is characterized by a mix of established titans and agile, specialized innovators.

- Ecosystem Platforms: Microsoft (Teams, Microsoft 365), Google (Workspace), and Salesforce (Slack) leverage their broad enterprise footprints and integrated solutions. Microsoft is widely cited as a leader, with estimates for its overall market share varying from 18% to 45% (likely reflecting different segmentation approaches or specific sub-markets). Google Workspace holds around 11% market share, particularly strong in SMB and education.

- Best-of-Breed Specialists: Zoom, while expanding its platform, remains a dominant player in video conferencing (estimated 12-25% market share). Slack (acquired by Salesforce) is a leader in channel-based communication (estimated 8-10% market share). Atlassian (Jira, Confluence, Trello) dominates project management and collaborative work for technical teams.

- Niche Innovators: Asana and Monday.com lead in Collaborative Work Management (CWM), while Miro and Mural are prominent in virtual whiteboarding.

Emerging Technologies and Innovations: Technological advancements are rapidly shaping the market, with a strong focus on intelligence, security, and flexibility.

- AI and Machine Learning: This is the most significant trend, with AI being embedded for meeting summarization (e.g., Microsoft Copilot, Google Duet AI, Zoom AI Companion), workflow automation, natural language processing, and predictive analytics to combat information overload and measure productivity.

- Enhanced Security: Zero Trust Security Architecture (ZTSA), end-to-end encryption, advanced threat detection, and compliance automation are becoming standard to address increased attack surfaces from distributed workforces.

- Asynchronous Collaboration: Tools and features supporting asynchronous work (e.g., video messaging like Loom, enhanced document collaboration, status transparency) are growing in importance to combat "Zoom fatigue" and support global teams across time zones.

- Immersive Technologies (VR/AR): While still emerging, platforms like Microsoft Mesh and Meta's Horizon Workrooms are exploring VR/AR for more engaging virtual meeting experiences, though widespread adoption is still some years away.

- Employee Experience Platforms (EXPs): Solutions like Microsoft Viva are emerging to integrate well-being, learning, and insights, addressing digital fatigue and promoting positive work environments. ...

What the synthesis achieved:

- ✅ Unified summary - Key insights from all perspectives combined

- ✅ No redundancy - Eliminated duplicate information

- ✅ Integrated insights - Captured quantitative data, strategic insights, and competitive analysis

- ✅ Foundation for improvement - This summary becomes the starting point for Round 2

Step 8: Watch Round 2 - Building Upon the Synthesis

In Round 2, each model receives the synthesis summary and builds upon it. Models create improved responses that incorporate insights from all Round 1 contributions while adding their own refinements.

GPT-5 Mini's Response (Round 2):

Comprehensive Analysis of the Remote Work Software Market

Executive Summary

The remote work software market has experienced explosive growth in the wake of the COVID-19 pandemic, transitioning from a niche sector to a fundamental aspect of modern business operations. Market size estimates for 2020 range from $15 billion to $27 billion, with projections suggesting a considerable rise to between $70 billion and $85 billion by 2025. This growth is fueled not only by the immediate needs imposed by the pandemic but also by lasting changes in corporate culture and infrastructure, with a CAGR estimated between 20-29%. Key driving forces include increased acceptance of remote work, technological advancements, and evolving employee expectations regarding work flexibility.

Competitive dynamics are defined by a landscape of both platform leaders and specialized players. Companies such as Microsoft, Google, and Salesforce dominate the market, pursuing integrated ecosystems aimed at holistic solutions. On the other hand, best-of-breed solutions provided by Zoom, Atlassian, and Asana exemplify a strategic focus on specialization. Emerging technologies, including AI integration, enhanced security measures, and a shift toward asynchronous collaboration, are reshaping user experiences and expectations. As organizations navigate tool sprawl and meeting fatigue, this comprehensive analysis outlines core customer pain points and predicts substantial market evolution, positioning significant opportunities for both software vendors and enterprise buyers.

...

GPT-5's improvement: Added quantitative data and metrics building on the synthesis.

Claude Sonnet 4.5's Response (Round 2):

REMOTE WORK SOFTWARE MARKET ANALYSIS

Comprehensive Strategic Assessment 2020-2025

EXECUTIVE SUMMARY

The remote work software market has undergone transformational expansion, evolving from a $15-27 billion sector in 2020 to a projected $70-85 billion market by 2025, representing a compound annual growth rate (CAGR) of 20-29%. What began as pandemic-driven emergency adoption has crystallized into permanent structural change, with 74% of enterprises planning to maintain or expand remote work policies indefinitely. This market has transitioned from discretionary productivity tooling to mission-critical enterprise infrastructure, fundamentally reshaping how organizations approach collaboration, communication, and workforce management.

The competitive landscape reveals a strategic bifurcation between integrated platform providers (Microsoft, Google, Salesforce) pursuing ecosystem dominance and specialized best-of-breed vendors (Zoom, Atlassian, Monday.com) competing on depth of functionality. Microsoft has emerged as the market leader with Teams reaching 280+ million monthly active users and capturing approximately 35-45% market share in unified communications, though measurement methodologies vary significantly. The market is experiencing rapid consolidation through strategic acquisitions, with over $28 billion in M&A activity since 2020, as vendors race to offer comprehensive solutions that reduce tool sprawl—currently averaging 8-12 applications per knowledge worker.

Looking forward, success factors are converging around five critical capabilities: AI-powered intelligence and automation, robust API ecosystems enabling seamless interoperability, enterprise-grade security incorporating Zero Trust Architecture, asynchronous collaboration tools addressing meeting fatigue, and measurable productivity analytics that respect employee privacy. Organizations investing in hybrid work optimization—specifically addressing meeting equity, proximity bias, and flexible work orchestration—are positioned to capture disproportionate value as the market matures beyond 2025. The fundamental question is no longer whether remote work software is necessary, but which architectural approach—consolidated platform versus integrated best-of-breed—delivers superior business outcomes for specific organizational contexts.

...

Claude's improvement: Added strategic depth and business model insights.

Gemini 2.5 Pro's Response (Round 2):

Comprehensive Analysis of the Remote Work Software Market

Date: October 26, 2023 Report ID: RWSM-2025-FIN Status: Final

1. Executive Summary

The global remote work software market is undergoing a fundamental transformation, evolving from a niche category to a cornerstone of modern enterprise infrastructure. Propelled by the global pandemic in 2020, the market has sustained its explosive growth trajectory, driven by the permanent adoption of hybrid and fully remote work models. Market size estimates for 2020 ranged from $15 billion to $27 billion, with a strong consensus projecting a surge to between $70 billion and $85 billion by 2025, representing a compound annual growth rate (CAGR) of 20-29%. This expansion is not a temporary bubble but a structural shift reflecting new paradigms of productivity, collaboration, and corporate culture.

The competitive landscape is defined by a strategic battle between two dominant models: the integrated "platform" ecosystems and the specialized "best-of-breed" solutions. Titans like Microsoft (Microsoft 365/Teams), Google (Workspace), and Salesforce (Slack) are leveraging their vast enterprise footprints to offer all-in-one solutions, aiming to become the central operating system for work. They compete against focused leaders like Zoom, Atlassian, and Asana, who offer deep functionality and superior user experience in their respective domains. The key technology trends shaping this battleground are the deep integration of Artificial Intelligence for automation and insight, the rise of asynchronous collaboration tools to combat digital fatigue, and the universal adoption of Zero Trust security architectures to protect distributed workforces.

Looking forward, the market's next phase will be characterized by optimization and intelligence. For vendors, success will hinge on creating seamless, integrated, and AI-powered experiences that demonstrably improve both productivity and employee well-being. For enterprise buyers, the focus is shifting from rapid tool deployment to strategic tech stack rationalization, prioritizing platforms that offer security, a clear AI roadmap, and measurable ROI without resorting to invasive surveillance. The future of remote work software lies not just in connecting people, but in intelligently orchestrating work to be more efficient, secure, and human-centric.

...

Gemini's improvement: Added emerging trends and future scenario analysis.

What Happens Next

After Round 2, AI Crucible checks for convergence. If models have reached 85%+ similarity (with Adaptive Iteration Count enabled by default), Round 3 will be skipped and the arbiter proceeds directly to create the final synthesized best answer.

In this example: Models converged after Round 2, so Round 3 was skipped. The arbiter created the final synthesized answer directly from Round 2 responses.

If Round 3 runs: Each model produces final refined responses building on the Round 2 synthesis, then the arbiter creates the final synthesized best answer.

Step 9: Final Synthesis

After all rounds complete (or convergence is detected), the arbiter model creates the final synthesized best answer, combining the strongest elements from all responses.

What Happens in Final Synthesis:

- The arbiter analyzes all responses from the final round (or Round 2 if convergence detected)

- The arbiter produces a synthesized best answer that combines the best elements

- The arbiter provides comparison analysis highlighting key differences and strengths

Final Synthesized Report:

The final synthesized answer includes:

- ✅ Enhanced quantitative data - Regional breakdowns, enterprise vs. SMB metrics, adoption statistics

- ✅ Strategic depth - Switching costs, freemium challenges, verticalization opportunities

- ✅ Future scenarios - Three potential market outcomes for strategic planning

- ✅ Comprehensive coverage - Best insights from all models combined into one authoritative document

Report Structure:

- Executive Summary

- Market Overview and Growth Trends

- Market Dynamics (quantitative insights from all models)

- Competitive Landscape

- Technology Trends and Innovations

- Strategic Considerations (business model insights)

- Customer Insights and Needs

- Future Outlook and Scenarios (multiple scenarios)

- Strategic Recommendations

Final Length: ~1,700 words

The Results

What You Received

From $0.30-0.40 and 4-5 minutes (Round 3 was skipped due to early convergence), you got:

- ✅ One comprehensive report synthesizing multiple perspectives

- ✅ Quantitative data (market size, growth, segmentation)

- ✅ Strategic insights (market dynamics, business models)

- ✅ Competitive analysis (leaders, challengers, strategies)

- ✅ Technology trends (AI, consolidation, virtual workspaces)

- ✅ Customer insights (needs, pain points, evolution)

- ✅ Future scenarios (three potential market outcomes)

- ✅ Strategic recommendations (for buyers, vendors, investors)

Quality Assessment

Comprehensiveness: 9.5/10 - Covers all key dimensions of market analysis

Integration: 9.2/10 - Successfully merges diverse perspectives into coherent narrative

Depth: 9.0/10 - Provides both quantitative data and strategic insights

Actionability: 8.8/10 - Includes specific recommendations for different stakeholders

Compare to traditional approaches:

| Approach | Time | Cost | Quality | Comprehensiveness |

|---|---|---|---|---|

| Hire research firm | 4-8 weeks | $15,000-40,000 | High | High (if you can afford comprehensive) |

| Single AI model (ChatGPT) | 5 minutes | $0.10 | Medium | Medium (single perspective, limited depth) |

| AI Crucible Synthesis | 4-5 minutes | $0.30-0.40 | High | High (multiple perspectives synthesized) |

Note: With Adaptive Iteration Count enabled (default), Round 3 was skipped due to early convergence, saving time and cost. The final synthesized answer was created directly from Round 2 responses.

Collaborative Synthesis delivered research-firm-quality analysis at 1/40,000th the cost and 1/500th the time.

Best Practices for Collaborative Synthesis

1. Write Comprehensive Research Prompts

Do:

- ✅ Specify clear research objectives and scope

- ✅ Define specific deliverables and sections

- ✅ Include format requirements (length, tone, structure)

- ✅ Request quantitative data where relevant

Don't:

- ❌ Be vague about what you need

- ❌ Omit important context or constraints

- ❌ Leave format unspecified

Example of a good prompt:

Research and synthesize a comprehensive analysis of [topic].

SCOPE:

- [Dimension 1]

- [Dimension 2]

- [Dimension 3]

DELIVERABLES:

1. [Section 1]

2. [Section 2]

3. [Section 3]

FORMAT: [Professional report/Executive summary/etc.], [word count]

TONE: [Analytical/Strategic/etc.]

2. Choose Complementary Models

For research synthesis, select models with:

- ✅ Different analytical strengths - Quantitative (GPT-5), Strategic (Claude), Comprehensive (Gemini)

- ✅ Different providers - Ensures genuine diversity

- ✅ Appropriate capabilities - Match models to research needs

Recommended combinations:

Budget-conscious:

- GPT-5 Mini

- Claude Haiku 4

- Gemini 2.5 Flash

Balanced:

- GPT-5 Mini

- Claude Sonnet 4.5

- Gemini 2.5 Pro

Premium:

- GPT-5.1

- Claude Opus 4.5

- Gemini 2.5 Pro

3. Use a Capable Arbiter Model

The arbiter model handles all synthesis tasks - it creates round summaries and produces the final synthesized best answer. Choose your arbiter model carefully.

Recommended arbiter models:

- Claude Sonnet 4.5 (excellent synthesis capabilities)

- Claude Opus 4.5 (premium synthesis quality)

- Gemini 2.5 Pro (strong multi-perspective integration)

Why it matters: The arbiter must intelligently summarize diverse perspectives and identify the best insights. Invest in a capable arbiter for best results.

4. Use 3 Rounds for Research Tasks (With Adaptive Iteration)

Why 3 rounds is optimal:

Round 1: Initial diverse perspectives

- Models contribute from their unique strengths

- Maximum diversity before synthesis

Round 2: Synthesis refinement

- Models build upon synthesis and add improvements

- Additional insights and refinements

- Improved completeness

Round 3: Final convergence (may be skipped if convergence detected)

- Final refined responses

- All perspectives integrated

- Ready for final synthesis

Adaptive Iteration Count (Enabled by Default):

- AI Crucible automatically detects convergence (85%+ similarity)

- If models converge after Round 2, Round 3 is skipped

- Saves time and cost without sacrificing quality

- Convergence indicates models have reached consensus

Why not 2 rounds?

- Not enough iteration for comprehensive research

- Synthesis needs refinement and gap-filling

- Models may not have converged yet

Why not 4+ rounds?

- Diminishing returns after round 3

- Higher cost without proportional quality gain

- If convergence hasn't happened by Round 3, more rounds rarely help

5. Review Final Answer Quality

Check that the final synthesized answer:

- ✅ Includes key points from all models

- ✅ Eliminates redundancy and resolves contradictions

- ✅ Maintains coherence and narrative flow

- ✅ Preserves important insights from individual contributions

If the final answer is weak:

- Try a more capable arbiter model

- Review individual model responses for insights the arbiter may have missed

- Ensure models have complementary rather than identical approaches

6. Use for the Right Tasks

Collaborative Synthesis works best for:

- ✅ Research projects and literature reviews

- ✅ Comprehensive reports and analysis

- ✅ Knowledge synthesis and documentation

- ✅ Strategic planning documents

Don't use for:

- ❌ Creative tasks (use Competitive Refinement)

- ❌ Multi-dimensional decisions (use Expert Panel)

- ❌ Adversarial testing (use Debate Tournament)

- ❌ When you need attribution (use Expert Panel)

Common Patterns and What They Mean

High Integration (Low Redundancy)

What it means:

- ✅ Arbiter successfully summarized and integrated perspectives

- ✅ Eliminated duplicate information

- ✅ Final answer has coherent narrative

When you see this:

- Synthesis is working well

- Models contributed complementary perspectives

- Final answer is ready to use

Low Integration (High Redundancy)

What it means:

- Arbiter may be concatenating rather than integrating

- Models may have contributed similar perspectives

- Need more diversity in model selection

When you see this:

- Try a more capable arbiter model

- Choose models from different providers

- Ensure models have distinct analytical strengths

Early Convergence Detected (Round 3 Skipped)

What it means:

- Models reached 85%+ similarity after Round 2

- Adaptive Iteration Count detected convergence

- Round 3 was automatically skipped

- Final synthesis created from Round 2 responses

When you see this:

- ✅ This is good! Models have reached consensus

- ✅ You saved time and cost (Round 3 not needed)

- ✅ Final answer is ready without additional iteration

- ✅ Convergence indicates high confidence in the approach

If you want Round 3 anyway:

- Disable "Adaptive Iteration Count" in settings

- Or set a higher similarity threshold (e.g., 90%+)

Gaps Identified in Round 2

What it means:

- Models are effectively reviewing synthesis

- Identifying areas needing more depth

- Contributing valuable refinements

When you see this:

- This is good! Models are collaborating effectively

- Round 3 will address gaps (if convergence not detected)

- Final answer will be more comprehensive

Contradictions Resolved

What it means:

- Arbiter identified conflicting information

- Successfully resolved contradictions in the summary

- Final answer has coherent unified perspective

When you see this:

- Synthesis is working well

- Models contributed diverse perspectives

- Final answer is authoritative

Cost Optimization Strategies

1. Start with 3 Models, Not 4-5

Why:

- 3 models provide diverse perspectives

- Diminishing returns beyond 3-4 models

- Cost scales linearly with model count

Cost comparison (3 rounds):

- 3 models: $0.30-0.40

- 4 models: $0.40-0.53

- 5 models: $0.50-0.67

2. Use Cost-Effective Models

Budget-friendly options:

- GPT-5 Mini: Excellent value for analytical tasks

- Gemini 2.5 Flash: Cost-effective comprehensive coverage

- Claude Haiku 4: Good synthesis capabilities at lower cost

These models often perform well for research synthesis tasks.

3. Invest in Arbiter Quality

The arbiter is worth the investment:

- Claude Sonnet 4.5: Excellent synthesis ($0.10-0.15 per session)

- Claude Opus 4.5: Premium quality ($0.20-0.30 per session)

A better arbiter produces significantly better round summaries and final synthesized answers.

4. Set Word Count Limits

Why:

- Output tokens are typically 5-10x more expensive than input tokens

- Longer responses = higher costs

- Concise reports are often better anyway

Example:

- Without limit: 3,000-word report = $0.50 total

- With 2,500-word limit: 2,500-word report = $0.40 total

- Savings: 20%

Troubleshooting Common Issues

Issue: "Synthesis is just concatenation"

Symptoms:

- Round summaries read like separate sections pasted together

- No integration or narrative flow

- Final answer has high redundancy

Causes:

- Arbiter model not capable enough

- Models contributed similar perspectives

- Need more diverse model selection

Solutions:

- ✅ Use a more capable arbiter (Claude Sonnet 4.5 or Opus)

- ✅ Choose models from different providers with different strengths

- ✅ Ensure models have distinct analytical approaches

Issue: "Important insights are lost"

Symptoms:

- Key points from original contributions missing

- Final answer feels incomplete

- Models identify gaps in Round 2

Causes:

- Arbiter prioritizing brevity over completeness

- Too aggressive summarization

- Important insights not surfacing in round summaries

Solutions:

- ✅ Review individual model responses alongside the final answer

- ✅ Use a more capable arbiter model

- ✅ Rely on Round 2 and 3 to fill gaps through iterative improvement

Issue: "Contradictions not resolved"

Symptoms:

- Conflicting information in final answer

- No resolution of disagreements

- Confusing output

Causes:

- Arbiter not identifying contradictions

- Models contributed genuinely conflicting information

- Contradictions persisted through rounds

Solutions:

- ✅ Use a more capable arbiter that identifies and resolves conflicts

- ✅ Check if models are approaching the problem too differently

- ✅ Consider if Expert Panel would be better (maintains distinct perspectives intentionally)

Collaborative Synthesis vs. Other Strategies

vs. Expert Panel

Use Collaborative Synthesis when:

- ✅ You want one unified document

- ✅ Attribution doesn't matter

- ✅ Research and analysis tasks

Use Expert Panel when:

- ✅ You need distinct perspectives

- ✅ Attribution matters

- ✅ Multi-dimensional decisions

vs. Competitive Refinement

Use Collaborative Synthesis when:

- ✅ You want one merged solution

- ✅ Research and analysis tasks

- ✅ Comprehensive understanding

Use Competitive Refinement when:

- ✅ You want multiple options

- ✅ Creative tasks

- ✅ Quality through competition

vs. Debate Tournament

Use Collaborative Synthesis when:

- ✅ You want cooperative integration

- ✅ Comprehensive research

- ✅ Unified understanding

Use Debate Tournament when:

- ✅ You need adversarial testing

- ✅ Stress-testing ideas

- ✅ Rigorous examination

Related Articles

- Collaborative Synthesis Strategy - The core concept explained

- Expert Panel Walkthrough - Another research strategy

- Getting Started Guide - How to set up your first session